Dopamine, Girl Crush, Y2K, Maillard… This year, the color cosmetics market is awash with a variety of styles.The color cosmetics market is leaping from “recovery” to “growth” after going through a painful retrenchment. According to Euromonitor’s forecast, the size of China’s color cosmetics market will reach RMB 111.3 billion by 2028, with an average annual growth rate of 7.5% from 2023 to 2028.The growth of the color cosmetics market is greatly affected by the growing consumer demand. On one hand, color cosmetics is needed in both online and offline socializing. Young people like to show themselves on social medias, and fashionable color cosmetics has become a visual form of self-expression. On the other hand, there is a growing demand for self-pleasing, and color cosmetics does just that. Finally, the “lipstick effect” still exists. Color cosmetics products like lipsticks and eye shadows are more affordable than other luxury goods and can help boost self-confidence.

In September this year, the sales of color cosmetics products on Tmall was RMB 1.714 billion and in August this year, the sales of color cosmetics products on JD.com was RMB 630 million, an increase of about 23% month on month.

01.

What is the current status of the color cosmetics market?

From the perspectives of consumers and the market, we have found that China color cosmetics market has strong growth potential with some changes.

1

ConsumersThere is still much room for growth in per capita consumption, and the categories are constantly enrichedIn terms of per capita consumption data, compared with other countries, China’s per capita consumption of color cosmetics products still has much room for growth. According to Euromonitor’s data, the per capita consumption of color cosmetics products in China in 2021 was RMB 46.5, while it is RMB 344 in the United States, RMB 242 in South Korea, RMB 178 in Japan and RMB 117 in France, indicating a considerable potential for improvement.In terms of consumer demand, consumers own increasingly diversified categories of color cosmetics products. According to the Research Report on the Use of Beauty Products by Chinese Consumers, Chinese female consumers own an average of 10 skin care products and an average of 16.2 color cosmetics products. The penetration rate for liquid foundation, concealer, color cosmetics fixer spray and eye color cosmetics have increased rapidly.With the increasing demand of Chinese consumers for color cosmetics products, the pursuit of diversified and individualized consumption will further drive the development of China’s color cosmetics market.

2MarketDomestic goods rise in a competitive market with various categories

China’s color cosmetics market is highly competitive, not only among domestic brands, but also between domestic and international brands. However, with the improvement of R&D and production technology of local color cosmetics enterprises, consumers have a higher recognition of domestic products. The growth rate of local color cosmetics enterprises should not be underestimated. For example, YSG, the parent company of Perfect Diary, and Zhejiang Yige, the parent company of Florasis, have seen a rapid increase in market share despite being founded only a few years ago (in 2016 and 2014 respectively). The former has grown from a market share of 1.7% in 2017 to 7.6% today, while the latter has grown from a market share of 0.3% in 2017 to 6.8% today.

On the recent pre-sale list for Double Eleven, there is a significant presence of domestic color cosmetics brands. Among the top 10 pre-sale color cosmetics bands on Douyin, seven spots are occupied by domestic brands. Five domestic brands are listed among the top 20 pre-sale color cosmetics brands on Tmall, namely TIMAGE, Flower Knows, MAOGEPING, blank me and Colorkey.

Fierce competition has promoted the rapid growth of domestic brands as they have found their positioning and launched various categories to cater to different consumer groups. For example, Flower Knows and Judydoll, known for their “affordable domestic color cosmetics”, specializing in lip, eye color cosmetics and blush color cosmetics products, attract consumers through visually appealing designs and high cost-effectiveness below RMB 100. MAOGEPING and TIMAGE, renowned for their “high-end domestic color cosmetics”, have established a popular brand image of “Chinese professional color cosmetics” while raising the brand premium. Funny Elves and blank me, as professional base color cosmetics brands, stand out by developing professional base color cosmetics products that replicate those of well-known international brands.

In the future, with further advancements in scientific research and production technology of color cosmetics enterprises and the continuous growth of emerging domestic brands, China’s color cosmetics industry is expected to maintain rapid growth and become an important force in the global color cosmetics market.

02.

What are new opportunities in the future for the color cosmetics market?

Driven by consumers’ increasing demand for rich color cosmetics categories and fierce market competition, the color cosmetics market tends to be increasingly detailed and diversified, implying many business opportunities.

1

ColorismBold, individualized and vibrant colors are highly favored by young consumers

The main consumer group have become increasingly younger, and these young consumers who like to break conventions and experience novelty are no longer satisfied with their everyday color cosmetics. Instead, they demand bolder, more individualized and more vibrant colors in color cosmetics products such as eyeshadow, lipstick and eyeliner. Global Google Trends shows a 250% increase in searches for “rave color cosmetics” over the past 12 months, with a 250% increase in searches for “glitter eye shadow”.

Under the influence of “colorism”, some emerging domestic brands have stood out by making breakthroughs in color matching. Examples include Kaleidos, which portrays a sense of futuristic technology, and GirlCult, a domestic trendy color cosmetics brand with avant-garde and exquisite visual design.

It is worth noting that at present, these bold and innovative color cosmetics brands attract more “advanced color cosmetics consumers”. However, as more and more color cosmetics KOLs share products, experience and color cosmetics methods on social platforms, the concept of “color cosmetics retrofitting” will quickly become popular among young consumers, and this niche market will see more brands.

2

Men’s color cosmeticsTapping into the potential for men’s color cosmetics to meet men’s demand for “self-pleasing consumption”

Driven by “self-pleasing consumption”, numerous color cosmetics brands tailored for women have emerged, but men’s color cosmetics actually has great development potential.

According to CBNData, over 60% of people approve of men wearing color cosmetics, and Chinese men’s demand for color cosmetics and hair styling has increased significantly, second only to outfits. On the other hand, the scale of online color cosmetics consumption by men is expanding year by year, and the compound growth rate of the consumer group has significantly exceeded that of women.

Today, with the improvement of men’s aesthetic taste and spending power, men’s recognition of color cosmetics has improved. However, there are only a handful of color cosmetics brands tailored for men, leading to an insufficient supply in the market. This also means that men’s new color cosmetics brands with distinct product identity will attract attention from investors.

3Clean color cosmeticsEco-friendly, healthy, safe and is favored by consumers

In the past two years, clean beauty has been a thriving sector in the industry. According to the 2023 White Paper on Clean Beauty, the growth rate of China’s clean beauty market has surpassed the global average, with a compound growth rate exceeding 10% from 2021 to 2024.

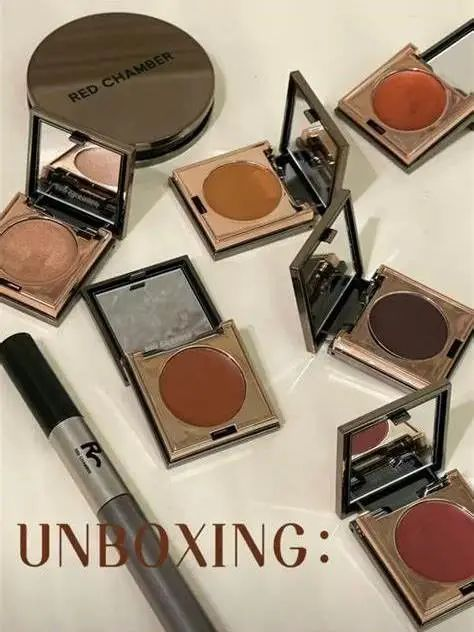

Clean color cosmetics, as a subclass of clean beauty, has the same huge development space. Consumers are more inclined to choose color cosmetics products that are safe, healthy, skin-friendly and eco-friendly. Investors also favor clean color cosmetics brands. In July this year, RED CHAMBER, a Chinese clean color cosmetics brand, completed financing of tens of millions of RMB.

It is evident that clean color cosmetics is still a sector worthy of attention and investment. At the same time, it also puts forward higher requirements for the R&D and production technology of color cosmetics enterprises.

4“Skin care” base color cosmeticsBase color cosmetics should have both color cosmetics and skin care effects

The concept of “color cosmetics and skin care in one” is gradually gaining popularity. More and more color cosmetics consumers are now seeking base color cosmetics products that balance skin care ingredients with color cosmetics effects.

According to the Report on the Trends of Face Base Color cosmetics in the Post-COVID-19 Era jointly released by CBNData and Yigrowth,with the continuous penetration of health concepts in the color cosmetics industry, consumers hope to keep good skin condition while using cosmetics. In line with this trend, more color cosmetics products claiming skin care benefits have emerged. Among them, skin care base color cosmetics accounts for 94% of the skin care color cosmetics market.

In addition, as the color cosmetics needs of consumers with sensitive skin are continuously tapped, there has been a growing focus on base color cosmetics products designed for this group. Brands such as Monster Code and Supple Supple have emerged as representative color cosmetics products for consumers with sensitive skin.

Aided by anti-allergy, anti-aging, whitening and skin care, the added value of base color cosmetics products is further enhanced. However, how to perfectly integrate color cosmetics and skin care efficacy and achieve the effect expected by consumers is a test for the R&D capabilities and production technologies of enterprises.

Overall, the consumer market of color cosmetics has revealed exuberant demand. In the highly competitive color cosmetics market, in order to seize market share and occupy the minds of consumers, brand enterprises not only need to present product designs that better align with contemporary consumers’ aesthetic taste and grasp fashion trends, but also need to further update and upgrade their R&D and production technologies to meet consumers’ more detailed, diversified and higher requirements for color cosmetics products.